OTHER TOP RATED ARTICLES: DO DIGITAL NOMADS NEED A WORK PERMIT IN THAILAND?

The debate on what work foreigners are allowed to do in Thailand repeats itself regularly on the internet and there is a lot of confusion about this topic, partly due to lack of clarity from the Thai authorities and partly due to misinformation amongst foreigners.

Here's a practical summary of what you need to know about working in Thailand (based on first hand sources).

Sounds logical and simple, and this is as much as you would learn from surfing superficial social media: you cannot work in Thailand without a work permit. Sure, agreed.

The legislation concerned here is the Foreign Workers Act1 (B.E. 2551 or A.D. 2008) which says that foreigners need to obtain a work permit from the Department of Employment (Ministry of Labor) to be allowed to work in Thailand, and the Foreign Business Act2 (B.E. 2542 or A.D. 1999), which sets out how foreigners can do business in Thailand.

There really isn't any dispute about this, the real issue is about the interpretation of what constitutes work by different authorities within Thailand.

MOST OF THE DEBATE ON FOREIGNERS WORKING IN THAILAND

IS ABOUT HOW DIFFERENT AUTHORITIES INTERPRET "WORK"

If you think that by applying the two relevant sections of Thai law the discussion about work by foreigners should have ended, you're wrong, that's perhaps how it would work in your home country but not in Thailand.

First of all, it's probably fair to say that Thai law isn't as accurate and developed as in some other countries. Most of Thai law was more or less imported or copied from amongst others European law just about a century ago and even according to Thai lawyers, it isn't exactly the most coherent or best organised system of law in the world.

The current definition of work is described in section 4 of the Foreign Workers Act as: "engaging in work by exerting energy or using knowledge whether or not in consideration of wages or other benefits".

Now, when dealing with foreigners, various departments of the Thai government are left to judge by themselves when a foreigner is working or not. So, it's very well possible that different departments judge a situation differently: some might say a foreigner is working, others say he's not.

A broad interpretation of section 4 by some authorities could be that even signing a document in Thailand by a foreigner constitutes an act of work, and therefore the foreigner would need a work permit!

A more narrow interpretation of section 4 was made by the Council of State (the Thai government's official legal advisory body) in 2015 at the request of the Office of the Board of Investment to give a legal opinion on the matter.

This interpretation is mostly based on economical factors, it states that the spirit of the Act is to protect Thai workers and occupation opportunity for Thais and to protect the national security, while considering the demand for foreign labour as necessary for the development of the country.

To put it simply, the Council of State advised that an activity could be considered "work" if it has an impact on the local labour market.

Just because you're working in a co-working space you're not being targeted for "working" in Thailand

Following this more narrow interpretation, the Department of Employment in 2015 decided that a number of activities previously considered "work" would now be allowed in Thailand without a work permit: attending a seminar, having a business meeting, doing a training, negotiating a deal and so on.

You might think that some of these activities are natural to doing business internationally and should be allowed without a work permit, but this has not been so obvious in Thailand.

This new, more narrow definition of "work" explicitly allows foreigners to do more activities without a work permit and will also help to somewhat reduce the differences in interpretation of what is "work" between different departments.

Still, you have to realize that every department of the Thai government has its own responsibility and will judge a case based on its own interpretation of what a foreigner can and cannot do. Some activities carried out by a foreigner might be of concern to one department, and not to other departments. After all, Thailand wouldn't be Thailand if huge differences in interpretation wouldn't persist not only between different departments but also between regions4.

Besides for persisting differences in interpretation of what is "work", Thailand wouldn't be Thailand if there wasn't a GREY ZONE where things are allowed to be as they are, unlike in some Western countries where things are more simply black-and-white.

Even knowing that certain activities are not really white, authorities often take a practical stance in dealing with them, taking into consideration the scale and seriousness of the activities, the particular situation, the unclarity of their own internal regulations, a sense of realism of what should be allowed and not and their willingness and capacity to enforce on rules.

The still persisting unclarity of rules and the lack of enforcement give space to abuse on both sides: on the one hand, some foreigners can carry out non-100% legal activities knowing that no one is going to check on them anyway, on the other hand it opens the door for corruption where Thai officials see it as a way to earn black money or even business partners can report foreigners to authorities for not acting 100% according to the rules when a relationship turns sour.

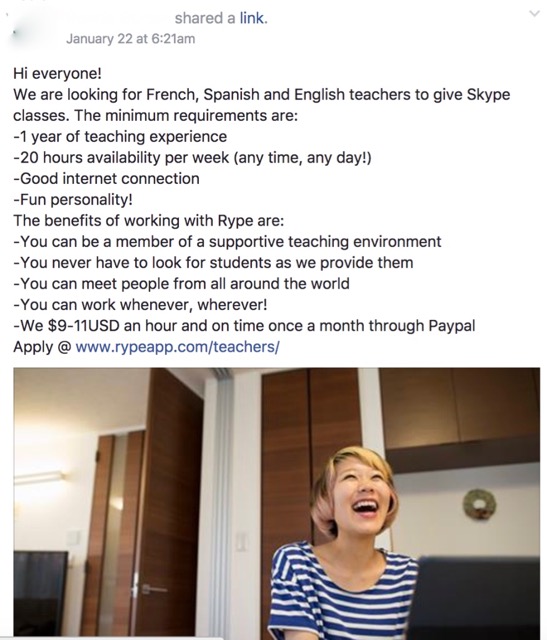

An example of an advertisement which aims to recruit foreigners for work

which strictly speaking is illegal in Thailand without a work permit

Now that we understand some of the background of the debate on "work" in Thailand, let's go more practical and have a look at some typical cases of activities that foreigners in Thailand engage in. Do they need a work permit or not?

To examine how the authorities deal with this in Chiang Mai, CM Locator interviewed officials of the Work Permit Office in Chiang Mai, with a special focus on relatively new activities such as carried out by Digital Nomads in Chiang Mai.

From this interview, it emerged that while probably most Digital Nomads in Chiang Mai are effectively working and therefore officially need a work permit, they are not a main concern to the Work Permit office (yet) and therefore are allowed to 'do their thing'. However, the red flag goes out when:

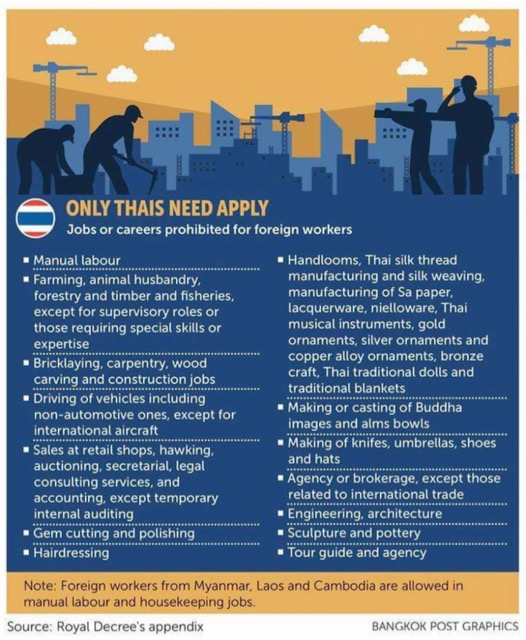

Some jobs are for Thai nationals only. Source: Bangkok Post

The Work Permit office may go to check when there is a problem or when somebody is reported.

Exemption: If you enter Thailand on a non-immigrant visa to carry out urgent and necessary work within a period of 15 days, you don't need a work permit but officially you still need to notify the Department of Employment in advance.

Note how there can be subtle but essential differences in activities that can lead the authorities to judge that this is "work", for example if a foreigner is an employee of an organisation that organizes a meeting or seminar and the foreigner co-organizes the seminar or meeting this is considered "work", but if a foreigner only attends the meeting or seminar it is not.

Full interview with the interesting perspective of the Chiang Mai Work Permit Office, read here.

If and how a foreigner receives payment for "work" in Thailand is in the law not the main criteria to judge whether a foreigner works in Thailand.

In a way surprising, because a foreigner could say that he's just helping out and is not getting paid to argue that he doesn't work. Also, logically, a case where a foreigner is "helping out" without getting paid should perhaps be considered less serious than a case where a foreigner is clearly receiving payment.

It also means that foreigners cannot simply hide behind the argument of 'volunteering'.

However, the authorities can consider payment and the payment channel as one of the factors to judge a case and besides that clear payment trails are of course like smoke: it's hard to deny there's a fire.

Some lawyers do warn that receiving payment in Thailand for an activity can be a criteria to judge it as "work" and surely it can be a trigger to lead authorities to investigate a case.

Because Thai authorities don't give 100% clear guidelines as to what is allowed and what is not allowed, it's better to stay out of trouble and avoid any suspicions by either one of the relevant authorities. Bases on the information we collected, your chances to stay out of trouble are best when:

This is not to encourage foreigners or Digital Nomads to work illegally in Thailand, but acknowledging how the Thai authorities work and think, what can become a concern to them, realistically this is how you can stay best out of trouble.

An example of an advertisement which aims to recruit foreigners for work

which strictly speaking is illegal in Thailand without a work permit

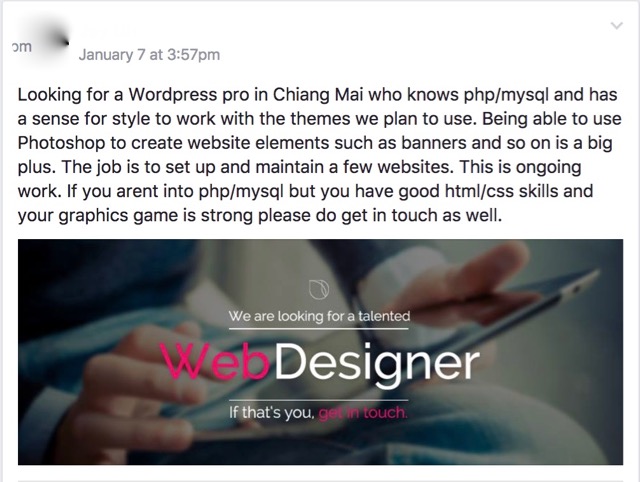

An example of an advertisement which aims to recruit foreigners for work

which strictly speaking is illegal in Thailand without a work permit

Especially if the government thinks that foreigners threaten safety and lives and property of Thai people by working illegaly in Thailand, the punishments can unlike anything you'd expect from the usual Thai smile approach: a maximum jail term of 5 years and fines up to THB 100,000. The fines involved with illegal work were recently (June 2017) multiplied by a factor 5-8 (!).

Foreigners being questioned over illegal work (source: Khaosod English)

If you fall into one of the categories judged by the authorities to be real "work" in Thailand, you need to:

This means in sequence that the main authorities you have to deal with are: the Immigration Department, the Labour Office and the Tax Department.

ad 1. The type of visa required depends on the type of work: English teachers need a teacher visa, volunteers need a volunteer visa and others need a business visa. You are not allowed to work with a tourist visa or retirement visa, usually there is a clear stamp in the visa stating "employment prohibited".

ad 2. To get a work permit, you have to be employed by a Thai company and that company needs to employ at least 4 Thai workers for every foreigner with a work permit.

ad 3. If you stay in Thailand for a period of longer than 6 months, you have to pay taxes.

The main criteria that the Tax authorities use to determine whether or not you have to pay tax as a foreigner is how long you stay in Thailand. If you stay longer than 6 months, you are supposed to pay personal income tax on the foreign income transferred into Thailand. However, you would not have to pay taxes over foreign income you made before coming to Thailand that you now remit into Thailand.

This is practically a rather obscure rule, because it's hard to distinguish what money you sent into Thailand if you also have some savings: one could argue you made money a year ago, then added that to your savings, and then sent that into Thailand, while in fact you made foreign income while being in Thailand. So you could apply a FIFO (first-in-first-out) accounting principle on your foreign income + savings.

Anyway, all this means that it is very hard for the Thai authorities to know that you are eligible for tax payment on your foreign income remitted to Thailand, while you are staying in Thailand.

The Tax authorities in Chiang Mai take a pragmatic stance towards the nature of your work and whether or not you have an official entity (company) in Thailand. You can register with your address and start paying taxes rightaway.

No one likes paying taxes, but realize that the benefit of registering and paying your income tax here is that you can later prove in your home country that you did pay taxes somewhere else5. Besides that, it is a nice way to give back to Thailand for the facilities that you used.

If you stay in Thailand long-term, there is now no excuse anymore to say you can't pay taxes!

1. Translation of Working of Alien Act B.E. 2551: See PDF file

2. Translation of The Foreign Business Act B.E. 2542: See website page

3. Legal article by Narit & Associates: See PDF file

4. Examples of different interpretations between regions:

5. Whether or not taxes are taken into account in your home country depends on what home country you're from and on bilateral tax treaties between your country and Thailand.

Share your experience here as a comment.

OTHER TOP RATED ARTICLES: DO DIGITAL NOMADS NEED A WORK PERMIT IN THAILAND?

Leave a comment

Note: By posting a comment or question, you will not automatically be notified when other people respond to your post (as in some other social media message threads). Please check the thread yourself if you’re interested in this topic.

| Beto Posted on September 22, 2018 at 07:19:22 This article can confuse a lot of people. Saying that "if you stay longer than 6 months you are supposed to pay taxes" is very vague, not to mention is not even always true. According to Thai law, if you stay longer than 6 months and don't work in Thailand, you only pay tax on the foreign income remitted into Thailand. It's well known that if you remit to Thailand money you earned in previous years, you have no obligation to pay tax. So, to clarify, no, you don't always have to pay tax if you stay longer than 6 months. Most foreigners earning their money overseas don't qualify as liable for tax, for the reasons I exposed. | |

| T D Bob Posted on June 08, 2017 at 04:38:21 The USA does NOT care if you pay taxes in THAILAND,...US citizens are required to pay US taxes regardless of tax payments made to another country. | |

| marco Posted on April 27, 2017 at 21:14:32 My story is too long so I keep it short! I would love to pay taxes in Thailand. I think the perfect way for DN would be to get a rip-off on your (bank) bussiness account. If this is, for example, 10% without dealing with visa trips I believe a lot of DN will go for that. Just give an easy oppurtunaty to open a bank account as a DN (cq bussiness) and Thailand will know they get 10% of it! In the meanwhile ... if you're able to teach kids in school and in programming it's double fun! Thailand 4.0 is not a bad way of thinking in this world. Thailand is trying to be part of (and be part) ...I would love to help with my knowledge. There are people that don't want to pay tax ... maybe they have another bussiness in Hong Kong or elsewhere. You will allways have this people and I cannot blaim them because it's possible. Where ever I live ... I like to drive on streets with good concrete not destroying my bike or car. I like to drive in the dark with streetlight. I like to live in a country where you have to pay your bills directly (electricity, water)! Tell me about one country in the world where things are better!? I can also understand that this tax-system can be stupid for Thai persons that make a lot of income. Because they pay the Thai tax-rate and it will go up the more you earn. at the end... complex but it will be fantastic for the people that want to stay long term in Thailand. | |

| Bethany Posted on March 03, 2017 at 04:35:17 My question is then...if a person is employed by an online company (not a Thai company) and is payed through their home country bank account...and lives in thailand, how do these laws apply? | |

| LivinLOS Posted on July 23, 2016 at 10:56:16 An article justifying law breaking and tax avoiding in a poor country simply because its too poor and weak to fully enforce its laws. There's a clear employment prohibited on the tourist visa, another declaration you must sign on the app not to work, and every labor dept official has been crystal clear. Its against the law unless you pay your taxes and have a work permit. http://www.phuketgazette.net/issuesanswers/Do-need-0145business-visa-work-online/1175 http://www.phuketgazette.net/issuesanswers/Is-uploading-videos-YouTube-considered-work/1532 No one likes taxes, but making up lies to pretend its not clearly against the law, by miss quoting immigration who are not bothered or involved in labor law, or simply saying 'its ok we dont get caught' misses the big picture. Countries live, thrive, educate their young, and grow, based on taxes being remitted. Simply abusing the hospitality of poor countries because they are weak, is hardly a high moral ground. | |

| Arnold Posted on November 22, 2015 at 11:57:24 Still, I would keep a low profile as maybe one day Immigration is targeting online workers | |

| Mark B Posted on September 04, 2015 at 06:46:21 This is about the first overview I read about this topic that really gives me some answers. Thaivisa and some other sites are simply unreadable and give me more questions than answers |

©2025 chiangmailocator.com. All rights reserved. Powered by annuaire SEO.